Customer Due Diligence

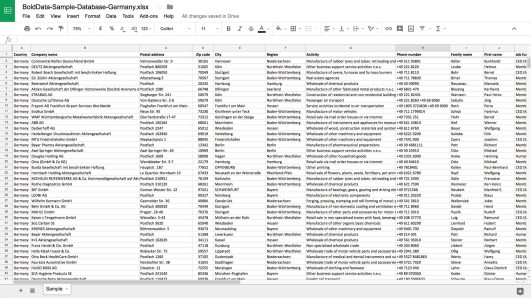

Optimize your customer due diligence processes in days with instant access to 287,987,792 companies, UBO’s and financial information. BoldData connects to hundreds of financial registries, public registers, entity data and company owners ship structures. Our customer due diligence data serves your with quick and transparent results to identify fraud, verify customer identities and maintain compliancy.

Optimize your Customer Due Dilligence process, in nearly every country.

With BoldData you will find all the necessary business information to meet the sanction obligations in the field of client verification, locating the UBO(s), client monitoring and archiving supporting documents for the audit trail. Who is your potential client, who are the owners, what does the client do and what is the risk involved? If you have that clear for every client, you know exactly who you are doing business with. And more importantly: you avoid doing business with criminal or fraudulent parties. Our company data and API is can be utilized as a CDD risk platform. It’s scalable, fast and includes a range of modules so you can build your own solution. You can also automatically integrate this information into your client acceptance and client monitoring system using our APIs. This way you automate your CDD processes and make compliance with the sanctions acts a lot easier. BoldData is the world’s market leader in custom-made datasets. Our company data is the backbone for other customer due dilligence providers, financial institutes, legal companies, banks, government, e-commerce and gaming companies.

Here’s how you can get compliant:

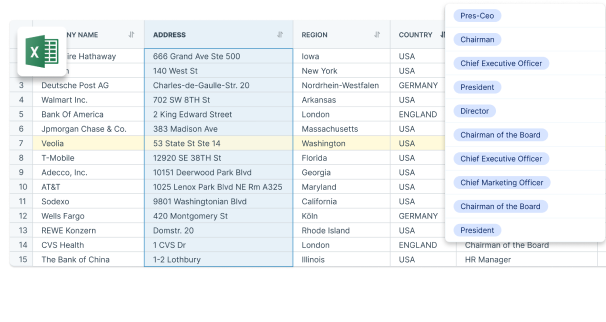

Verify business data

Verify new customers based on registration number, national ID, VAT number address, legal status, date of incorporation, contact information, phone number and URL.

Identify and check Ultimate Beneficial Owners (UBO’s)

Find out the Ultimate Beneficial Owner (UBO) or ultimate beneficial owners and the ownership and control structure of the group to which the client belongs.

Check a company’s financial strength

Keep ahead of the curve by checking a companies balance sheet, credit scores, shareholders, profit & loss and other financials.

Download financial statements

Download official company records sources from public registries and credit institutions.

What is Customer Due Diligence

Institution subject to the Wwft must know your clients before you accept them. Who is your potential client, who are the owners, what does the client do and what is the risk involved? If you have that clear for every client, you know exactly who you are doing business with. And more importantly: you avoid doing business with criminal or fraudulent parties. Another word for CDD is KYC, or Know Your Customer. These terms actually mean the same thing: to know your clients and the associated risks.

If an effective customer due diligence process is not put in place, this can lead to hefty fines, sanctions or even public ridicule. In the U.S., Europe, the Middle East, and the Asia Pacific, a cumulated USD26 billion in fines have been levied for non-compliance with AML, KYB, and sanctions-fines the past ten years (2008-2018) – let alone the reputational damage done and not measured.

Want to optimize your due diligence?

We deliver data for all CDD purposes. From a dataset of private companies to an seamless connection by API. Tell us your CDD challenge and country and we send you a free quote. Call +31(0)20 705 2360 or send an e-mail to info@bolddata.nl.