Credit plays a significant role in the modern world as a financial tool. Credit allows individuals to make purchases they may not have the immediate cash to pay for. With this in mind, it is essential to understand what a credit report is and how it affects your financial well-being.

What is a Credit Report?

A credit report is a comprehensive document that contains your financial history. It includes information about your credit cards, loans, mortgages, and other lines of credit. This document tracks your payment history, outstanding debts, and past delinquencies. The information is then used to generate a credit score, a numerical value reflecting your creditworthiness.

How Does a Credit Report Work?

Credit reports are compiled by credit reporting agencies, also known as credit bureaus. These agencies collect financial information about individuals and businesses from various sources, such as banks, credit card companies, and lenders. They use this information to create a detailed report that outlines a person’s credit history. There are four main business credit bureaus: Dun & Bradstreet, Equifax, creditsafe and Experian. Each produces multiple scores to give potential creditors insight into your business’s financial health and likelihood of on-time payments.

When you apply for credit, such as a loan or a credit card, the lender will request a copy of your credit report from one or more of these agencies. They will use the information in the report and other factors, such as income and employment history, to determine whether or not to approve your application. A high credit score indicates that you are a responsible borrower and will likely repay your debts on time. A low credit score, on the other hand, may result in a denial of credit or a higher interest rate.

What Factors are Included in a individuals Credit Report?

Credit reports contain a wide range of information about your financial history. Some of the factors that are included in a credit report include:

- Payment History: This section of the report details your payment history for all lines of credit, including credit cards, loans, and mortgages. It shows whether you have made your payments on time or if you have been delinquent in the past.

- Outstanding Debt: This section of the report shows how much debt you owe. It also includes your credit utilization rate, which is the percentage of your available credit that you are using.

- Length of Credit History: This factor considers how long you have had credit accounts open. A longer credit history is generally viewed as a positive indicator of creditworthiness.

- Credit Inquiries: Whenever you apply for credit, the lender will request a copy of your credit report. These requests are called credit inquiries and are recorded in your credit report.

- Public Records: This report section includes information about bankruptcies, foreclosures, and other legal actions that may have affected your credit.

Key Takeaways

In conclusion, a credit report is crucial to your company’s financial health. It provides lenders with a detailed snapshot of your credit history and helps them determine whether to approve your credit application. Understanding what a credit report is and how it works is essential for anyone who wants to maintain good credit standing. By monitoring your credit report regularly and taking steps to improve your credit score, you can ensure you have access to the credit you need when needed.

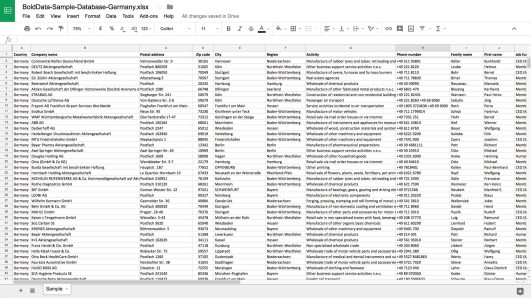

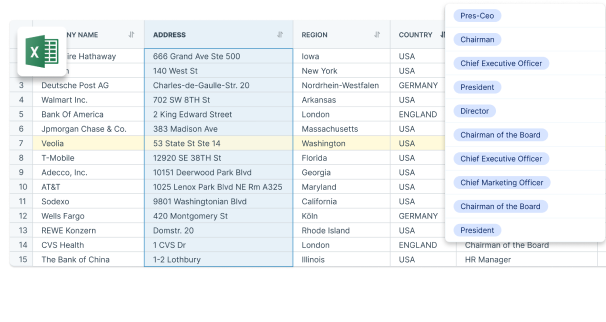

As a business owner, you understand the importance of making informed decisions that drive your company’s success. With BoldData’s Financial Data, you can have the information you need to make confident, data-driven decisions.

Our comprehensive financial data covers market trends, consumer behavior, and more, providing a complete picture of your industry and its potential. With BoldData, you can stay ahead of the competition and make strategic moves that drive your business forward.